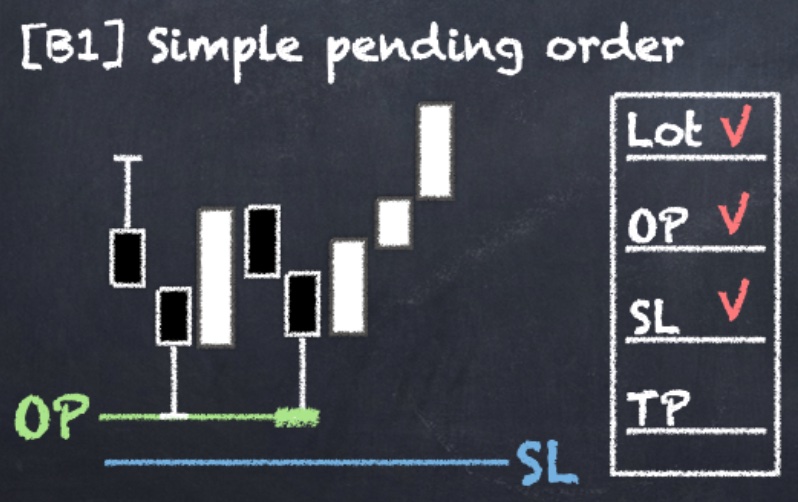

[B1] Simple pending order

The pending order with the entry point and close-price stop-loss defined by yourself

- Send the pending limit order with the open price and stop-loss.

- The last decimal of the stop-loss will be used to set the close price stop-loss.

A simple pending order can be used when you want to enter the market with your defined target entry point and close price stop-loss without targeting a specific Fibonacci retracement ratio. This EA will help you calculate and adjust the lot size and set the close price stop-loss. Unlike the Fibonacci pending order, the open price will not be moved by the EA after you set your ticket.

How to Send a Simple Pending Order

We will need to send the limit ticket with both the open price and stop-loss price.

- Open price: Any price that matches your entry goal.

- Stop-loss: The close price stop-loss, with the last decimal set as the time frame.

- Take profit: Not required.

If you want to set a take profit price, make sure the last decimal is set to 0. Otherwise, it will be treated as a [C] Fibonacci pending order and the open price will be dynamically adjust to specific retracement ratio.

Example 1Open a buy ticket for XAUUSD at 2032.328 with a stop-loss at 2025.321 using the M30 time frame. Hint: M30 time frame code = 0.004 Send a pending limit ticket with the stop-loss set at 2025.324 (2025.320 + 0.004) and the open price at 2032.328.

Example 2Open a market sell ticket for XAUUSD with a stop-loss at 2055.032 and an open price at 2045.098 using the H1 time frame. Send a pending sell ticket with:

- Open price: 2045.098

- Stop-loss: 2055.045 (2055.040 + 0.005)

- Round up the last decimal of the stop-loss for the sell order to 2055.040.

- Add the H1 time frame code of 0.005 to the last decimal to get 2055.045.